Cybersecurity News and Business Insurance: 2025 Premiums Impact

The latest cybersecurity news significantly impacts business insurance premiums in 2025, with insurers increasingly scrutinizing a company’s cyber risk profile and security measures to determine coverage costs.

Staying ahead of cybersecurity threats is crucial, especially when it comes to your business’s financial security. The impact of how the latest cybersecurity news affects your business’s insurance premiums in 2025 cannot be overstated, as insurers are now closely monitoring cyber risk profiles, and the premiums that you pay are increasingly based on this.

Understanding the Evolving Cybersecurity Landscape

The cybersecurity landscape is constantly evolving, with new threats emerging daily. Businesses need to stay informed about these threats to protect their assets and maintain favorable insurance premiums. Insurance companies are paying close attention to the types of cyberattacks businesses are vulnerable to.

Understanding the current trends, attack vectors, and vulnerabilities is essential for any business looking to secure its digital assets and manage its insurance costs. Ignoring these developments can lead to severe financial consequences.

Key Cybersecurity Threats to Watch

Businesses need to remain aware of the threats facing companies today to protect both their data and their bottom line.

- Ransomware Attacks: Ransomware remains a significant threat, with attackers demanding large sums to unlock encrypted data. Preventing these attacks is paramount for business continuity; if an attack occurs, it could also raise insurance premiums.

- Phishing Campaigns: Sophisticated phishing campaigns continue to trick employees into divulging sensitive information, leading to data breaches and financial losses. Employee training and awareness programs can mitigate that threat.

- Supply Chain Vulnerabilities: Cybercriminals are increasingly targeting vulnerabilities in supply chains to gain access to multiple organizations through a single point of entry. Reviewing how these vulnerabilities can be avoided is critical to protecting organizations.

Staying informed about these threats and implementing robust security measures is crucial for businesses looking to minimize their cyber risk and secure favorable insurance rates.

How Cybersecurity News Influences Insurance Underwriting

Cybersecurity news directly influences how insurance companies assess risk and determine premiums. Insurers are now leveraging threat intelligence and data analysis to understand the evolving threat landscape and tailor their underwriting processes.

This shift towards data-driven underwriting means that businesses with poor cybersecurity practices are likely to face higher premiums or even denial of coverage.

The Role of Threat Intelligence

Threat intelligence plays a crucial role in insurance underwriting, enabling insurers to assess the likelihood and potential impact of cyber incidents.

- Risk Assessment: Insurers use threat intelligence to evaluate a business’s vulnerability to specific cyber threats, considering factors such as industry, size, and geographic location.

- Policy Pricing: Based on the risk assessment, insurers adjust premiums to reflect the level of cyber risk a business poses. High-risk businesses will face higher premiums.

- Coverage Terms: Insurers also use threat intelligence to define the terms and conditions of cyber insurance policies, including exclusions and limitations.

Data Analysis Techniques

Insurance companies rely on data analysis to better understand their clients and the market.

- Predictive Modeling: Insurers use predictive modeling to forecast the likelihood of cyber incidents based on historical data and current threat trends.

- Benchmarking: Insurers compare a business’s security posture against industry peers to identify areas of weakness and potential vulnerabilities.

- Real-Time Monitoring: Some insurers offer real-time monitoring services to detect and respond to cyber threats as they occur, providing added protection for their policyholders.

By understanding how cybersecurity news influences insurance underwriting, businesses can take proactive steps to improve their security posture and secure more favorable insurance terms.

Implementing Robust Cybersecurity Measures

Implementing robust cybersecurity measures is essential for businesses looking to reduce their cyber risk and secure affordable insurance premiums. A comprehensive security strategy should include a combination of technological controls, employee training, and incident response planning.

Businesses that prioritize cybersecurity are more likely to be viewed favorably by insurers, leading to lower premiums and better coverage terms.

Key Cybersecurity Practices

There are several cybersecurity practices that, when put together, can have a major impact on any company or organization.

- Multi-Factor Authentication (MFA): Implementing MFA adds an extra layer of security, making it more difficult for attackers to gain unauthorized access to sensitive systems and data.

- Regular Security Audits: Conducting regular security audits helps identify vulnerabilities and weaknesses in a business’s security posture, allowing for timely remediation.

- Employee Training: Providing ongoing employee training on cybersecurity best practices can help reduce the risk of phishing attacks and other social engineering tactics.

Incident Response Planning

You can take steps to reduce the number of incidents that occur, but those events still do happen. Incident response planning will prepare you for that day.

- Develop a Plan: Creating a detailed incident response plan outlines the steps to take in the event of a cyberattack, including communication protocols, data recovery procedures, and legal considerations.

- Test the Plan: Regularly testing the incident response plan ensures that it is effective and that employees know their roles and responsibilities.

- Update the Plan: Updating the incident response plan to reflect changes in the threat landscape and business operations is crucial for maintaining its effectiveness.

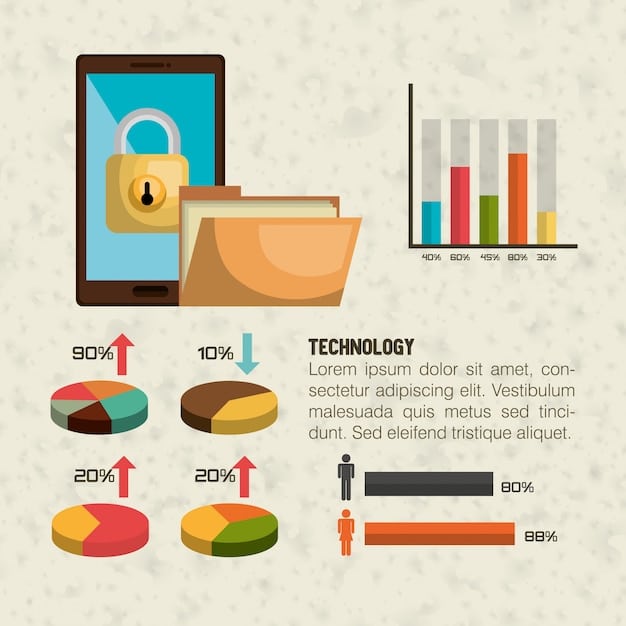

The Impact of Data Breaches on Insurance Costs

Data breaches can have a significant impact on insurance costs, with insurers often increasing premiums or denying coverage altogether following a breach. The severity of the impact depends on factors such as the size and scope of the breach, the type of data compromised, and the business’s response to the incident.

Businesses that experience a data breach may also face reputational damage, legal liabilities, and regulatory fines, further exacerbating the financial consequences.

Factors Influencing Premium Increases

There are several factors that go into the change in insurance premiums after an organization experiences a data breach.

- Size and Scope: Larger breaches that affect more customers or involve sensitive data typically result in higher premium increases.

- Type of Data: Breaches involving personally identifiable information (PII) or protected health information (PHI) are often viewed more seriously by insurers due to regulatory compliance requirements.

- Response to the Incident: Businesses that respond quickly and effectively to a data breach may be able to mitigate the impact on insurance costs.

Case Studies of Premium Adjustments

Looking at cases that have happened in the past can give businesses better insight into what may happen if they suffer a data breach.

- Retail Chain Breach: A major retail chain experienced a significant premium increase after a data breach exposed millions of customer credit card numbers.

- Healthcare Provider Breach: A healthcare provider faced a substantial premium hike following a breach that compromised patient medical records.

- Financial Institution Breach: A financial institution saw a moderate premium increase after a breach that exposed customer account information. The institution’s quick response and effective remediation efforts helped mitigate the impact.

Cyber Insurance Policy Considerations for 2025

As the cyber threat landscape evolves, businesses need to carefully consider their cyber insurance policies to ensure they provide adequate coverage for emerging risks. Policyholders should review their coverage limits, exclusions, and terms and conditions to ensure they align with their business needs and risk profile.

Working with an experienced insurance broker who understands the complexities of cyber insurance can help businesses navigate the market and secure the best possible coverage.

Coverage Limits and Exclusions

Coverage limits and exclusions are an important part of the process. Businesses need to keep these rules in mind as they consider what coverage may work best for them.

- First-Party Coverage: First-party coverage protects a business against its own losses resulting from a cyber incident, such as data recovery costs, business interruption losses, and notification expenses.

- Third-Party Coverage: Third-party coverage protects a business against claims from third parties who have been harmed by a cyber incident, such as customers whose data has been compromised.

- Exclusions: Common exclusions in cyber insurance policies include acts of war, intentional acts, and pre-existing conditions.

Policy Terms and Conditions

Be sure that you fully understand the policy terms and conditions when you are considering a new policy.

- Notification Requirements: Policies typically require policyholders to notify the insurer promptly after discovering a cyber incident.

- Cooperation Requirements: Policyholders may be required to cooperate with the insurer’s investigation of a cyber incident and to take steps to mitigate further damage.

- Dispute Resolution: Policies outline the procedures for resolving disputes between the policyholder and the insurer.

Reviewing your cyber insurance policy with current trends in mind will ensure that you are adequately protected. Businesses should also look to review their policies regularly to ensure they are protected.

Preparing for 2025: A Proactive Approach

Preparing for 2025 requires a proactive approach to cybersecurity and insurance planning. Businesses need to stay informed about the latest cyber threats, implement robust security measures, and work with experienced insurance professionals to secure appropriate coverage.

By taking these steps, businesses can minimize their cyber risk, protect their assets, and ensure their long-term financial stability.

Staying Informed

One of the cornerstones of cybersecurity is staying informed and aware of the threats that face organizations.

- Industry Publications: Subscribing to industry publications and newsletters can help businesses stay up-to-date on the latest cyber threats and security best practices.

- Cybersecurity Conferences: Attending cybersecurity conferences and events provides opportunities to learn from experts, network with peers, and discover new security technologies.

- Government Resources: Utilizing government resources, such as the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency (CISA), can provide access to valuable threat intelligence and security guidance.

Partnering with Experts

Partnering with experts, whether they are insurance experts or technology experts, can help businesses of all types.

- Insurance Brokers: Working with an experienced insurance broker who specializes in cyber insurance can help businesses navigate the market and secure the best possible coverage.

- Managed Security Service Providers (MSSPs): Partnering with an MSSP can provide access to specialized cybersecurity expertise and 24/7 monitoring and response services.

- Legal Counsel: Engaging legal counsel with expertise in cybersecurity and data privacy can help businesses navigate the legal and regulatory landscape and respond effectively to data breaches.

| Key Point | Brief Description |

|---|---|

| 🛡️ Evolving Threats | Cybersecurity threats are constantly changing: businesses need to stay up to date. |

| 📊 Data-Driven Underwriting | Insurers use data to assess risks, impacting premium prices. |

| 📉 Data Breaches | Data breaches often lead to significantly higher insurance costs. |

| 🤝 Expert Partnerships | Insurance brokers/MSSPs can help navigate cyber insurance complexities. |

Frequently Asked Questions

You should review your cybersecurity insurance policy at least annually. However, it’s also important to review your policy whenever there are significant changes to your business operations or the threat landscape.

Factors that influence the cost of cybersecurity insurance: include the size of your business, the industry you are in, the type of data you store, and the cybersecurity measures you have in place.

Cybersecurity insurance typically covers a range of cyberattacks, including data breaches, ransomware attacks, and phishing campaigns. However, policies can differ in which incidents and losses they cover.

You can improve your business’s cybersecurity posture by implementing key security measures such as firewalls, intrusion detection systems, anti-virus software, and multi-factor authentication. Businesses should also look at incident response planning.

After a data breach, you should contain the breach, notify affected parties, investigate the incident, and update your security measures. Consulting with legal counsel is crucial during this time.

Conclusion

In conclusion, staying informed about cybersecurity news and implementing robust security measures is essential for businesses looking to secure favorable insurance premiums in 2025. By understanding the evolving threat landscape, investing in cybersecurity, and working with experienced insurance professionals, businesses can protect their assets and ensure their long-term financial stability.